Fidelity SmartRetire mobile app encourages users to achieve better financial health

Fidelity International has been recognised in the Hong Kong Technology Excellence Awards for the app’s success.

Financial security has become increasingly important in recent years. The pandemic brought many uncertainties affecting ways of working, daily routines and how people plan for their future. It may have also impacted people’s emotions and financial wellbeing.

Fidelity International’s first Global Financial Wellness Survey revealed that for 77% of Hong Kong employees their happiness largely depended on how secure they feel financially. Meanwhile, one-fifth (21%) of surveyed respondents revealed they were very, or extremely, stressed about their financial situation.

Further, more than 60% of respondents did not feel on track to meet their financial goals (64%) and retirement goals (67%).

The survey was conducted among 17,000 workers across six global markets, including 2,300 working households in Hong Kong.

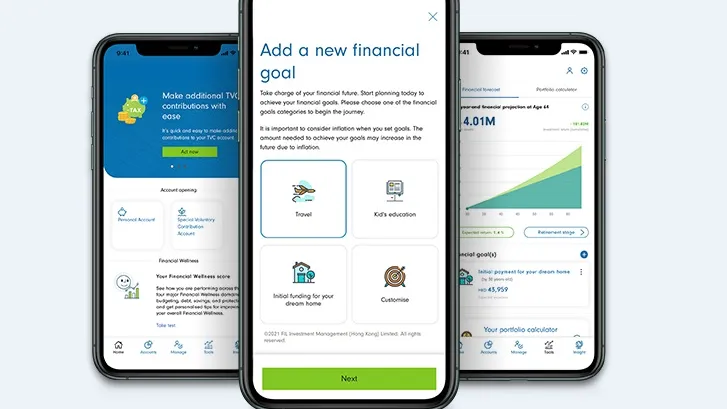

Recognising the realities being faced by many today, Fidelity International has introduced a suite of new financial planning capabilities in their SmartRetire mobile app to help members take control of their wealth anytime and anywhere.

In the recently concluded Hong Kong Technology Excellence Awards, Fidelity International won the Mobile - Financial Services Award for the SmartRetire mobile app. The award-giving body acknowledged that the app empowered Fidelity’s pension plan members in Hong Kong to make informed decisions to get into, and stay in, great financial health.

The app was recognised for its noteworthy features. The first of them being the Financial Wellness tool. Users of the tool can assess their current financial situation and receive personalised financial wellness scores by answering questions. The tool is backed by a recommendation engine whereby users can get financial planning tips tailored to their own financial situation.

The app also features a Financial Forecast tool with which users can build their financial profile and forecast their future wealth. The tool offers them the option of setting up financial goals at different life stages, and also enables them to calculate their retirement income based on their forecasted assets at retirement.

Another useful feature, the Portfolio Calculator, enables users to test out their own investment strategies using historical Fidelity funds data incorporated in the SmartRetire mobile app.

The public reception for the new tools was encouraging. The Financial Wellness tool and survey results were launched through a virtual press conference that garnered wide media coverage. Together with the digital campaign promoting public awareness on the importance of financial planning, we help members achieve their financial fitness and guide them through the planning journey with the SmartRetire mobile app.

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise