Chart of the Week: Office rental growth of non-core locations to outperform core district

Central vs Wan Chai's premium dropped to 46%.

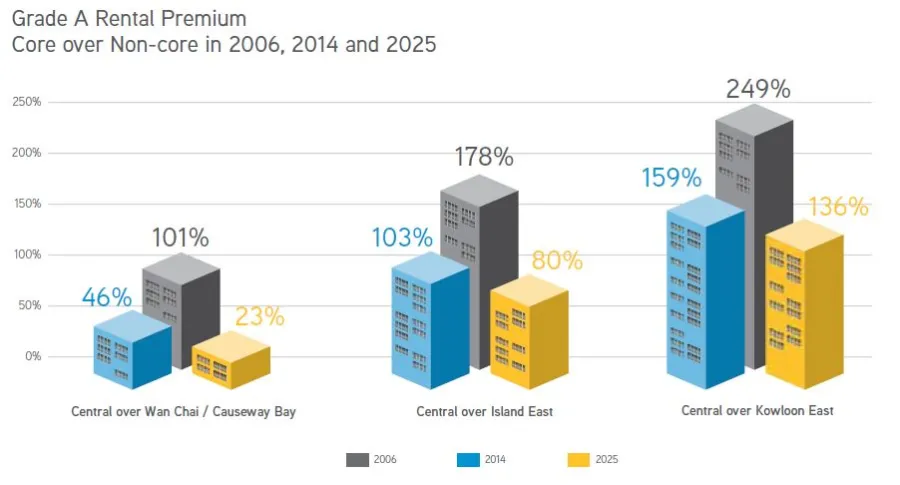

According to Collier's "The Evolution of Office space in Hong Kong," between 2006 and 2014, the rental premium of core over non-core locations contracted significantly thanks to the onset of the global financial crisis in 2008, its fallout, and the trend of increased decentralisation by cost-sensitive tenants.

For example, the rental premium of Central over Wan Chai and Causeway Bay declined from 101% in 2006 to 46% in 2014.

Here's more from Collier's:

The premium between Central and Island East fell from 178% to 103%. Central’s premium over Kowloon East also declined substantially from 249% to 159%.

For the next 10 years, we conclude that the rental premium of Central over Wan Chai and Causeway Bay will narrow from 46% in 2014 to 23% in 2025, fundamentally driven by the improved infrastructure development of the Central-Wan Chai Bypass and Island Eastern Corridor Link.

The Island East area will also benefit from the improved transportation network. As a result, we project that the

premium for Central over Island East will contract from 103% in 2014 to 80% in 2025. The premium between Central and Kowloon East will fall from 159% to 136% over the same period.In conclusion, the pace of rental growth in non-core locations of Wan Chai and Causeway Bay, Island East and Kowloon East will outperform the rate of growth in the core district of Central over the next decade. It is likely that Kowloon East will witness stronger take-up than Hong Kong Island, due to the sizable volume of new supply in the district, where it can offer major cost savings for occupiers.

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise