Office rents break seven-quarter growth with 1% dip in Q3

Average rents in Central declined the first time since Q3 2014.

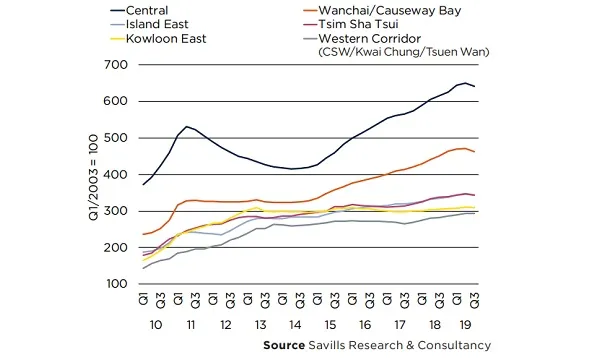

Office rents in Hong Kong ended its seven-quarter growth streak when it fell 1% in Q3, Savills Research reported.

Average rents in Central dropped by 1.3% for the first time since Q3 2014. Wanchai/Causeway Bayand Island East also experienced their first rental declines since 2014 at -1.6% and 1.1%, respectively.

Rents in Kowloon East and Tsim Sha Tsui likewise dipped 0.2% and 0.8% respectively, whilst Kowloon West rents remained unchanged.

Also read: Greater Central office rents to fall by up to 8% in 2019

Prospects for mainland firms and coworking operators, the demand drivers in the market, have dimmed, with senior staff in PRC firms becoming reluctant to visit Hong Kong due to growing concerns about their safety, and WeWork’s failure to list may have lowered fundraising aspiration of other operators to raise funds.

In contrast, vacancy rates stood at 3.8%, below the 5% threshold at which rental growth typically turns negative. “As a result, landlords are currently standing firm and not yet entertaining requests to lower rents,” Savills said.

New Grade A office supply is expected to total around 9.3 million sqft net from 2019 to 2023, an average of about 1.86 million sqft net per annum. Kowloon East may see the most significant supply, with 3.7 million sqft net or 39% of the total.

Only 1 million sqft net or 19.3% of the total supply will be situated in Central and all of it will be completed in 2023. New developments, including the Hutchison House and Murray Road Carpark developments and Site C of the Peel Street/Graham Street project, are expected to provide support for rents in Central with tightening availability in the run up to 2023.

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise