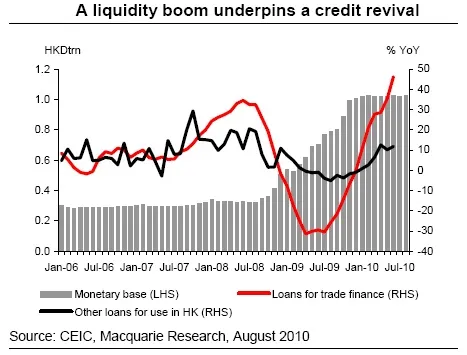

Hong Kong: A liquidity boom underpins a credit revival

Excess liquidity and very low interest rates will likely prevail given the potential for more capital flows into Hong Kong, according to Macquarie Research.

It said, “Net capital inflows under the HKD peg would continue to underpin a liquidity boom, holding costs of credit/capital low for consumers and businesses. A positive feedback loop of an entrenched economic recovery and easy bank credit reinforcing each other has revived domestic credit expansion. Loans for trade finance have been growing since May 2009, and the YoY growth in loans for other uses in Hong Kong also accelerated in 1H10.”

View the graph here.

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise