Malaysia is stuck with its longest slide in loan approval rates since 2009

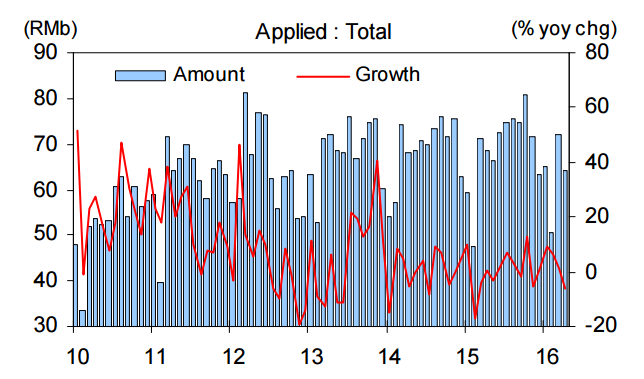

Loan approval dropped 17% in April.

In yet another telling sign of slowing credit growth, loan approval rates in Malaysia stayed in the red in April, marking the 10th consecutive month of a year-on-year contraction. This marks the longest consecutive monthly contraction in loan approval since 2009, according to a report by UOB Kay Hian.

The report noted that key areas of weakness in approval trends were residential property, non-residential property, automobiles, construction, and purchase of securities.

“Most loan segments recorded a decline in approval trends apart from personal loans which we believe could be attributed to tighter consumer cash flow constraints among the lower income segments due to rising cost of living,” UOB Kay Hian said.

Advertise

Advertise