Hong Kong

The privacy conundrum: Tackling the issue of the century

The privacy conundrum: Tackling the issue of the century

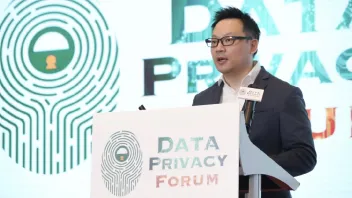

Crypto.com executive and HKB Management Awards winner Jason Lau answers some serious questions on data privacy.

7 in 10 Hong Kong tech firms plan global expansion in the next 12 months

1 in 2 have said they plan to increase investments in 5G technologies.

Commercial real estate investment deals hit $16.0b in Q2

This translates to a 17.5% increase from last quarter.

Warehouse vacancy drops to its lowest level in 8 years

Vacancy edged down to 1.4% in Q2 2022.

Leasing demand for Grade A office down 23% in Q2

Limited inspection activity caused the decline in leasing demand.

Property sales fell by almost 21% in June

Over 6,290 sale and purchase deals for all units were received for registration.

Waiting time for public rental housing to increase within 5 years

It was already increased to 6.1 years in March 2022.

High-street shop vacancy rises to 16.5% in Q2 22

Amongst core districts, Tsim Sha Tsui had the biggest vacancy rate.

High-street shop vacancy rose 1.3 percentage points from Q122 to hit 16.5% in Q2 22, data from CBRE showed.

The increase in vacancy was likely due to some landlords, who are under limited financial pressure, opting to leave units vacant rather than renting them out.

This practice was most evident in Tsim Sha Tsui and Mong Kok where vacancy rates were the highest, at 23.2% and 18.9%, respectively.

Whilst vacancy rose during the quarter, rents remained flat. According to CBRE, rents were unchanged from Q122 because “cash-rich landlords with strong holding power prevented some units from transacting at lower rents this quarter.”

In addition to rents being unchanged, leasing volume also increased in Q2, signalling an improvement in the retail property sector.

“Improved retailer sentiment underpinned an increase in transaction volume, although many deals signed this quarter involved short-term leases,” CBRE commented.

Hong Kong is 3rd most transparent property market in Asia

It recorded an overall score of 1.98.

Swap Connect to be built for HK, China's financial markets

It will debut in six months.

Chubb’s Hong Kong life business crucial for international expansion: analyst

It accounted for 15% of pre-tax income for the group.

ETF trading under Stock Connect kicks off

There are over 130 EFTs listed in Hong Kong.

IPO market to regain momentum in H2 2022

For the whole year, PwC expects Hong Kong to raise between $180m to $200m.

Rising interest rates to be Hong Kong banks’ saving grace

NIMs are expected to rise and outweigh asset quality deterioration in the near term.

Xi wants ‘one country, two systems’ unchanged

The Chinese leader said the principle was successful.

Lee seeks to strengthen HK status as international financial, trading centre

John Lee was sworn in as Hong Kong’s new leader.

HKEX to attract high-quality US-listed Chinese firms: PwC

Overall market capitalisation in Hong Kong reached $42t in 2021.

Advertise

Advertise