Hedge fund assets hit all-time high at $722.33b despite unrest

China’s growing economy, highly-trained talent and robust regulatory landscape boosted the figure.

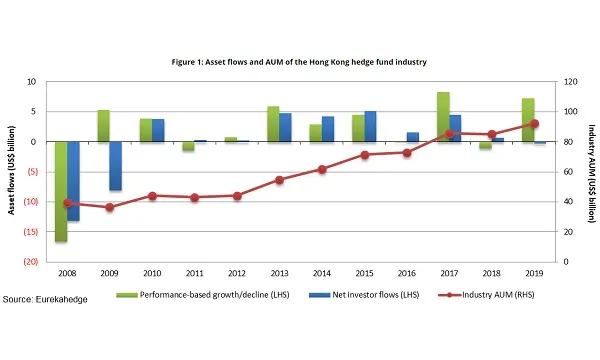

The hedge fund industry has accumulated a new high of $722.33b (US$92.1b) in August of assets under management (AUM) as its performance further rose despite the ongoing protests in Hong Kong, according to the research firm Eurekahedge.

This figure was raised by 449 hedge fund managers, growing $54.12b (US$6.9b) of AUM in YTD. It was attributed to proximity to the fast-growing economy of China, availability of highly-trained talent base, and robust regulatory landscape that has attracted both foreign and domestic hedge fund managers to base their operations in the region.

“Seen as the gateway to China, Hong Kong is uniquely positioned to benefit from foreign asset owners interested in allocating into the Greater China region, as well as domestic asset owners looking to gain international exposure,” Eurekahedge stated.

Total hedge fund assets have dipped by $3.14b (US$0.4b) in 2018 as fund liquidations outpaced new launches throughout the year. It has resulted in a net decline of 24 funds in the industry population. Equity markets have then picked up in Q1, thanks to the sell-offs they suffered in Q4 2018 as dovish central bank policies and the People’s Bank of China (PBOC) stimulus programmes provided support for the underlying markets.

Furthermore, the protests have led to the downgrading of Hong Kong’s credit rating by major agencies.

“Risk sentiment on the region’s hedge fund industry for the remainder of the year may also benefit from the dovish stance adopted by major central banks, and anticipation over further easing from the PBOC,” the report added.

Meanwhile, net investor redemptions from Hong Kong-based hedge funds totalled $2.35b (US$0.3b) over the 9M 2019 and is said to be the first negative net flows recorded by the industry since 2009.

Small to medium-sized hedge funds overseeing up to $3.92b (US$500m) in assets bore the brunt of the investor outflows since the beginning of the year, compared to its larger peers that have generated positive allocations YTD.

Since the end of 2007, Hong Kong-based hedge funds have generated an annualised return of 5.28%, which compares against the 4.39% returned per annum by the average Asian hedge fund over the same period.

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise