Home sales climbed 49.5% to 7,822 units sold in April

The property market could be warming up.

Residential sales surged 49.5% MoM in volume to 7,822 units in April, according to the Land Registry, which was the highest level of monthly transactions since September 2016, a monthly report by Knight Frank revealed.

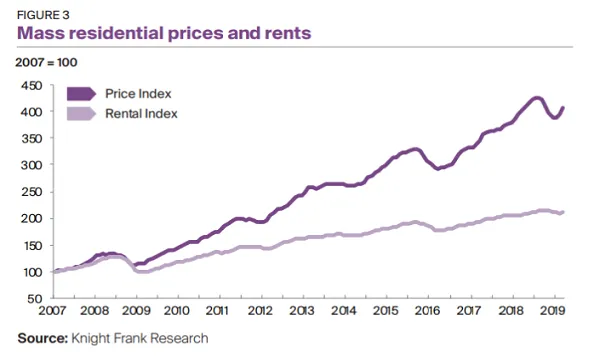

This has added to signs that the property market is rebounding, with prices expected to grow further, the firm said. The latest official data show that overall residential property prices edged up 5% in Q1 2019 over the previous quarter.

Also read: Hong Kong's property prices hit all-time high

According to Knight Frank Greater China’s director and head of research and consultancy David Ji, Hong Kong’s market saw healthy demand for primary residential properties.

“For instance, there was an oversubscription of close to 30 times at the Montara project in Lohas Park, which received 15,000 subscriptions for 500 units, and the Timber House project in Ho Man Tin was oversubscribed eight times,” he highlighted.

One other notable residential sales transaction over the month was a low floor unit at 8 Deep Water Bay Drive in Island South which sold for $605.4m or $80,000 psf. The development as a whole is said to be one of the priciest condos in the market.

Meanwhile, interest in luxury homes in the secondary market remained high, with Residence Bel-Air in Pokfulam recording 11 transactions in March and another 11 in April, compared to a total of seven in January and February.

“With corporations resetting their budgets entering the new financial year in April, luxury residential and serviced apartments saw higher leasing demand,” Ji added. Outside the traditional luxury areas, high-end properties in Tsim Sha Tsui and Kowloon Station gained popularity thanks to the high-speed rail.

Whilst the China–US trade dispute has put a dent in Hong Kong’s economic prospects, Ji noted that any adverse impact on the Hong Kong residential market may be temporary, as demand remains strong from both investors and end-users.

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise