Home sales dropped 10% to 4,089 in February

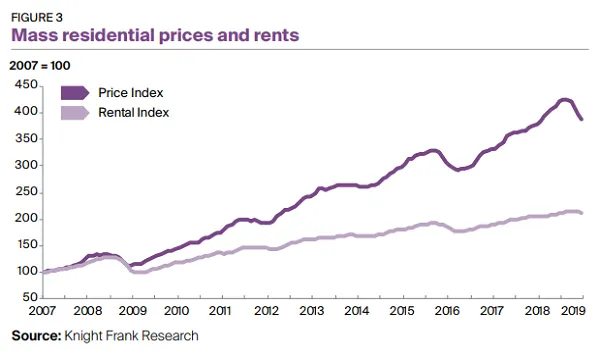

Sales have weakened ever since prices started falling in July 2018.

With the traditionally low season for Hong Kong’s residential market beginning in February, total transaction volume of residential units dropped 10% MoM to 4,089, according to a report by Knight Frank.

The monthly transaction has been under 5,000 units since July 2018, when the property prices started falling, the report highlighted. Although official data shows that overall property prices were up slightly 0.1% MoM in January, ending the five-consecutive-month drop, market sentiment remained weak. Notable residential sales transactions during the month included units at Masterpiece’s duplex unit H development in Tsui Sha Tsim selling for $220m, and units at Mount Nicholson in Island South going for an approximate $490m price tag.

“The low monthly transaction volume did little to improve buyers’ perspective of the market prospect,” Knight Frank added.

And whilst there have been sporadic luxury sales activities recently, with some investors capitalising on the recent stock market rally, activities in the luxury segment is unlikely to improve the overall residential market.

Nevertheless, Knight Frank’s recent research has found that Hong Kong ranks amongst the world’s top cities to attract private wealth. “This should provide support for long term price growth,” the firm explained, adding that the luxury leasing market saw a surge of stock of both houses and flats, especially those with relatively high monthly rent of $180,000 or above. That being said, the report noted that flats with asking rents of between $100,000–$120,000 per month can be leased out more quickly.

The report noted that monthly rents across Hong Kong in February ranged between $81,000-$195,000 for developments such as The Altitude in Mid-Levels East, Estoril Court in Mid-Levels Central and The Lily in Happy Valley. Most leasing activity in the luxury segment was also observed to be driven by local moves.

The Government's Budget proposed that the land sale programme in 2019–2020 would provide residential land for 8,800 units, whilst potential new residential supply could reach 15,500 units, including MTR projects, Urban Renewal Authority sites, and private redevelopments.

However, as these projects will not become available soon, they will have only a limited impact on the market.

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise