Hong Kong most at risk of overheating property prices

6 property measures imposed failed to dampen market demand.

Nomura believes that there is too much reliance on countercyclical policies to counter weak exports and not enough focus on structural reforms to boost the supply-side of economies and negative side effects are already emerging credit has been growing faster than nominal GDP across the region, and property markets are frothy in many capital cities.

Nomura mentions Hong Kong as a case in point.

Here's from Nomura:

In October, the real interest rate on 1yr bank deposits in China was 1.3%, while in the rest of Asia the average real policy rate, weighted by GDP, was just 0.3% – and this is during a period of low inflation in the region.

Central banks justify erring on the side of laxity as insurance against the downside risks to global growth, to promote domestic demand given the weakness of exports and to avoid provoking too-strong capital inflows.

From 1999 to 2005, we estimate that the real interest rate was negative 19% of the time in China and 10% of the time elsewhere in Asia, while from 2006 to 2012, this grew to 57% and 43%, respectively. But persistently negative real rates sow the seeds of overheating, and Asia‟s real policy rate is likely to turn negative again as inflation rises.

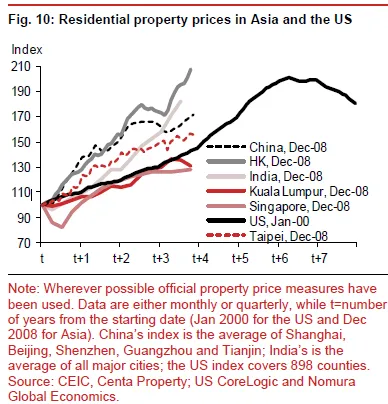

If we overlay residential property prices in the US (indexed to 100 in January 2000) on residential property prices in several Asian countries or major cities (indexed to 100 in December 2008), it is striking that prices in Hong Kong, India, China and Taipei are tracking above the US price bubble.

We see a danger in the likely increased use of macroprudential measures in an attempt to cool property markets and credit growth; these measures may work for a while but over time, as loopholes are found, they turn out to be a poor substitute for higher interest rates. Hong Kong is a case in point.

The Hong Kong Monetary Authority has progressively imposed higher stamp duties on property transactions and tighter restrictions on mortgage lending on six occasions since late 2009, but the property market has yet to cool. Central banks ultimately find themselves behind the curve in tackling credit booms, asset price bubbles and inflation.

Hong Kong seems most at risk, but we cannot rule out overheating in other countries, including China, India, Indonesia, Singapore and Taiwan.

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise