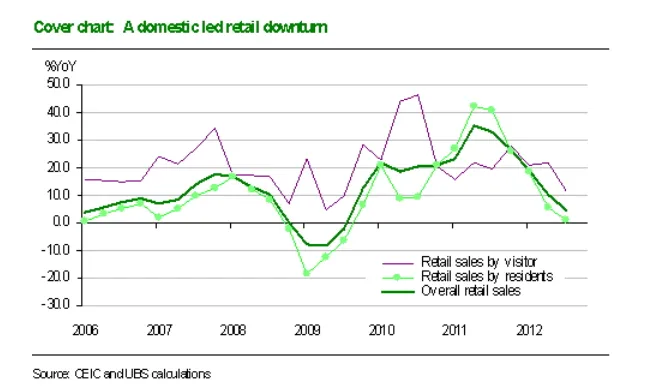

An ugly chart about HK retail in a downturn

Sales vallue has gone down a lot from 23%y/y in 4Q11.

Here's from UBS:

As we reflect on Hong Kong’s macro in 2012, the sharp slowdown in the retail sector—with sales value slowing from 23%y/y in 4Q11 to around 7% in the last few months—is no doubt one stand-out trend.

The fact that retail sales had significantly undershot market expectations made it all the more noticeable. Our view has long been more cautious. We highlighted two challenges facing the retail sector back in early 2012, namely the squeezes from weaker sales by both visitors and residents.

As we enter 2013, it’s time to take stock and, with it, cross check our current view. With hindsight, the sales downturn in 2012 was very much domestic led (see chart). This is contrary to the mainstream thinking, which continues to focus exclusively on the moderation in spending by the Chinese tourists

For sure, tourist related spending did slow, driven by some moderation in arrivals and a significant slowdown in per capita tourist spending. But the bulk of the sales slowdown in 2012, as shown by Chart 1, stemmed from the residents (still constitute 70% of total sales), which remain the key determinant of the retail cycle in Hong Kong. The good news is, after four quarters of sharp slowdown, resident sales are bottoming out.

But absence any significant stimulus (similar to the cash handouts in 2011), we reiterate our view that the cyclical rebound in sales this year should prove modest, certainly nowhere near the remarkable policy-boosted sales growth of 2010-2011.

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise