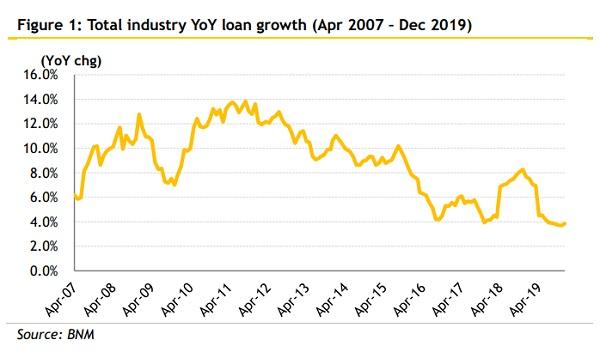

Chart of the Week: Malaysia's loan growth halved to 3.9% in 2019

Both household and non-household loan growth slowed.

Malaysia banks’ loan growth was halved to just 3.9% in 2019 from 7.7% in 2018, reports Maybank IB Research.

Both household (HH) and non-household loan growth registered declines. HH loan growth was only at 4.7% in 2019 compared to 8.3% in the previous year, whilst non HH loan growth was 2.7% versus the 6.8% recorded for the whole of 2018.

Within the household segment, only mortgage and credit card loan growth was robust at 7.3% and 6% YoY respectively.

In contrast, cumulative bond issuances for 2019 totalled $39.37b (RM128.9b), a 25% YoY rise from the $25.07b (MYR103.0b) in 2018. Including bank loans, total industry credit growth was 5.1% YoY in 2019.

Despite lower growth compared to 2018, 2019 HH loan growth remained stable largely due largely to the stable residential property loan growth, noted Maybank IB Research analyst Desmond Ch'ng. Non-residential property lending also picked up in momentum, as did personal lending, whilst auto financing contracted at a slower pace. Credit card loan growth remained robust at 6%, Ch’ng added.

For 2020, Ch’ng forecasts a faster loan growth of 4.3%, driven by stable household (HH) loan growth of 4.7% and slightly faster non-HH loan growth of 3.8%.

Advertise

Advertise