Financial Services

Banks' earnings remain weak as coronavirus cripples operations

Banks' earnings remain weak as coronavirus cripples operations

Around 20-30% of bank branches will likely temporarily close or shorten operating hours.

Majority of Gen Z use credit cards: survey

They have a median balance per consumer of $4,316 (US$555).

HSBC earmarks $3.9b in liquidity relief for local businesses

It is easing borrowing terms to aid companies affected by the coronavirus outbreak.

Credit Suisse calls off Hong Kong meet over coronavirus outbreak

The event was originally scheduled on 25-27 March.

Mastercard, Dah Sing Bank, BBPOS launch mobile payment app for SMEs

Tap on Phone allows merchants to accept contactless card payments.

Banks' profits threatened as nCov hits on credit demand, interest margins

Average credit losses are estimated to be 25bp-30bp.

Financial firms undermanned amidst 2019-nCov spread

Expect more delays in the completion of equity sales and bond deals.

Bank of East Asia closes 20 branches due to coronavirus

ATMs located within closed branches will also be unavailable.

HSBC Life extends nCov benefit programme to families of policyholders

Policyholders and families will receive complimentary benefits starting 1 February.

Banks urge Hong Kong staff to work from home after travels from China

Global banks are stepping up their measures amidst the coronavirus scare.

Sun Life Hong Kong floats new policies against coronavirus

They will be entitled to a waiting period waiver if diagnosed between 24 January to 30 April.

Asian retailers should consider investing in omnichannel experiences to stay relevant

Retailers gearing up for 2020 may have been urged to double down on technology to deliver the elusive optimal customer experience that hits all the...

UBS faces uphill battle to regain ground in Hong Kong after IPO ban

Handed in March last year, the ban was lifted two months earlier than expected.

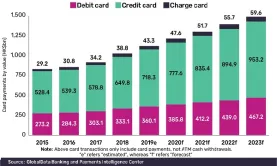

Hong Kong card payments value to hit $59.6b by 2023

The number of card payments is expected to hit 1 billion in 2020.

ZA Bank offers 6% introductory rate for deposits: report

The virtual bank’s rate is said to have outpaced the big traditional players’ offers.

Economic downturns threaten HSBC profits, restructuring: analysis

Low confidence levels could reduce demand for credit and lending and revenue growth.

Virtual banks to make up 2-3% of total deposits by 2020: report

They are expected to attract “tens and thousands of customers” each.

Advertise

Advertise