Japan

Japanese banking sector assets as a share of GDP now at a record 211%

Total assets were up 5.5% in November 2016.

Japanese banking sector assets as a share of GDP now at a record 211%

Total assets were up 5.5% in November 2016.

Robo-advisors: Booming in Japan

This post addresses trends in Fintech, with a focus on Robo-advisors and the unique attributes of Japan's financial market.

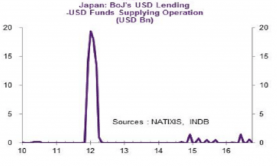

Japanese banks and US$ liquidity: Squeezed between expensive deposits and the BoJ

For the last few years, Japanese banks have aggressively expanded their assets overseas, which has helped increased their stubbornly low profitability even after the introduction of negative interest rates by BoJ. Such a successful overseas strategy, profitability-wise, may be at risk due to US$ liquidity developments at a global level.

Chart of the Week: Two risks haunting Japanese banks' balance sheets

Banks face maturity and higher interest risks.

Blueprints for Japan's next-generation payment infrastructure

This post examines initiatives to accelerate the development of Japan's payment infrastructure through the lens of the Zengin System—the heart of this infrastructure.

Legacy modernisation in Japan's financial industry

This post examines the current status and future outlook of legacy modernisation in Japan's financial industry based on a survey Celent conducted in 2015. The survey targeted insurers, financial institutions, and brokers. Additional information was gathered in follow-up interviews through 2016.

Japanese banks' margins hit record low as negative rates, steep forex costs bite

Profits are under threat on several fronts.

Japanese mega banks' earnings dampened by regional exposure

Profit dropped in the past months.

Tokyo gears up as epicenter of regional bank consolidation in Japan

Finally, some order in the fragmented sector has come.

Japanese banks to follow suit as Mizuho Bank launches robo advisor

Automated services are shaking Japanese banks' foundations.

Japanese banks' recurring profitability is alarmingly shrinking: Moody's

Is a profit wipe-out looming over the banks?

Japanese regional banks pressured to be more risk-taking

Due to negative pressure on asset yields.

Japanese mega banks' core profitability lacks momentum: Fitch Ratings

NIMs are sitll under pressure.

Japan megabanks remain cheap on the market despite recent rally

There's doubt on their growth potential.

BTMU announces creation of learning center in Myanmar

Possibly helping Myanmar's banking professionals' competencies.

India's Punjab National Bank most exposed to relapse risk

This could continue near-term.

Japan’s megabanks saw 22.3% profit surge to ¥718.86 in 4Q14

Thanks to lower credit costs and growing overseas business.

Advertise

Advertise